US: Money for nothing

Every three months, the US Federal Reserve releases its Senior Loan Officer Opinion Survey on Bank Lending Practices. This represents answers to questions on the loan markets answered by 76 domestic banks and 22 U.S. branches and agencies of foreign banks.

The survey published on July 31 included a set of special questions that asked respondents to describe the current levels of lending standards at their bank. Specifically, for each loan category surveyed, respondents were asked to consider the range over which their bank’s standards have varied between 2005 and the present and then to report where the current level of standards for such loans currently resides relative to the midpoint of that range.

According to the report, “Domestic banks reported that their current lending standards on all categories of C&I loans remained at levels that are easier than the midpoints of their respective ranges since 2005. A significant proportion of domestic banks reported that standards are currently easier than the respective midpoints for non-syndicated loans to both small and large and middle-market firms as well as for syndicated loans to investment-grade firms.” In plain English, domestic banks are so eager to lend to commercial and industrial corporations (as opposed to consumers or real estate) that they have relaxed their terms significantly to both small firms and large and middle-market firms.

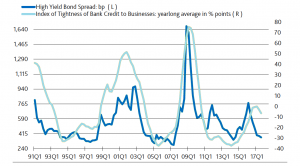

This message is borne out by spreads in the high-yield bond market. According to Moody’s Investor Services, the month-long average for the high-yield bond spread is at its lowest since July 2014’s 350 bp (see chart). The firm links this spread compression to a benign outlook for defaults. Moody’s Default Research expects that the US high-yield default rate will ease from a Q2-2017 average of 4.1% to 2.9% by Q2-2018.

At the same time, the survey reveals that demand for loans is falling. Outstanding bank C&I loans rose only 2.2% in the second quarter of 2017, compare with 10.2% in the same period last year. The good news then is that, as Moody’s says, there is “ample systemic liquidity” to fund re-financings or acquisitions. Treasurers should be able to get a good deal on debt. The bad news is that this level of falling loan demand has been an indicator of recession. “Recessions materialized within 12 months of the previous two comparable drops by the business sector’s demand for bank credit.” And foreign banks may already have called the top of the business cycle. Domestic banks may be keen to lend but the Fed survey reveals that “the current levels of [foreign bank] C&I lending standards are, if anything, generally tighter than the midpoints of their respective ranges.”

If you want to borrow in the US, now may be the time.

Narrowing of high yield bond spread reflects ample liquidity and is consistent with greater willingness by banks to loan to businesses

Source: Moody’s Investors Service, Federal Reserve, Moody’s Capital Markets